My money. The concept of a joint family wallet holds significant implications for married couples, serving as both a practical tool for financial management. Yes and a reflection of the partnership dynamic within a relationship.

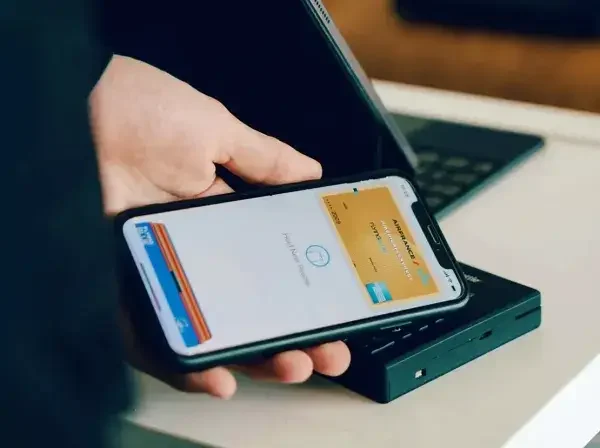

A joint family wallet refers to the pooling of financial resources, where couples combine their incomes and expenses to manage their finances collaboratively.

My money, Understanding the Joint Family Wallet.

This practice can foster stronger financial security and create a shared sense of responsibility that enhances the relationship.

One of the primary benefits of adopting a joint family wallet is the encouragement of transparency in financial matters.

When both partners contribute to and access shared resources, it lays the groundwork for open communication regarding spending habits, savings goals, and budgeting strategies.

This shared approach can also aid in developing a collective strategy for large purchases, reinforcing teamwork in achieving mutual financial objectives.

However, while merging finances can bring numerous advantages, it can also lead to potential conflicts.

Differences in spending habits, financial priorities, and individual financial histories may surface, necessitating careful negotiation and compromise.

It is essential for couples to engage in candid discussions about their financial values and expectations before implementing a joint wallet.

Establishing mutual goals and clearly defined roles within the framework of joint financial management can mitigate misunderstandings.

Reflecting on personal experiences often reveals that successful navigation of a joint family wallet requires ongoing dialogue and adaptability.

Couples who communicate effectively about money management are better equipped to address emerging issues constructively.

This proactive approach not only enhances their financial well-being but also strengthens their overall relationship.

By forging a path that balances individual needs with joint objectives, couples can create a harmonious and effective financial partnership.

How to Divide Finances in a Dual-Income Household?

In a dual-income household, finding an equitable way to divide finances can be a challenging yet essential task.

With both partners earning income, various strategies can be employed to determine contributions to the joint family wallet.

Understanding these methods can lead to a more harmonious financial partnership.

One effective approach is the percentage-based contribution method, where each partner contributes a certain percentage of their income toward shared expenses.

This way, the contributions are proportional to their earnings, ensuring that the financial burden is distributed fairly.

For example, if one partner earns significantly more than the other, a higher percentage can still accommodate both partners’ financial circumstances while maintaining balance in the household.

Another option is the fixed amount contribution, where each partner agrees on a specific dollar, eiro amount to contribute to joint expenses.

This method works well if both partners have similar income levels and can easily agree on a set contribution that meets their collective needs.

It is essential to ensure that the fixed contributions align with actual household expenses to avoid potential financial strain on either partner.

The needs-based approach focuses on prioritizing expenses based on necessity.

Each partner can review their individual and joint financial obligations, then contribute accordingly to cover essential costs.

This method emphasizes understanding and flexibility, allowing each partner to feel valued regardless of their financial contribution.

Regular conversations about spending and saving help maintain transparency and accountability.

Regardless of the chosen method, it is crucial for partners to assess their expenses carefully and set financial goals together.

Establishing a budget and tracking spending gives both partners insight into the partnership’s financial health.

This strategy not only promotes joint responsibility but also strengthens the relationship, ensuring that both partners feel appreciated for their financial contributions and involvement in managing the joint finances.

Potential Conflicts and How to Address Them.

When managing a joint family wallet, potential conflicts can arise due to varying spending habits, different financial priorities, and diverse levels of financial literacy among family members.

These differences often lead to misunderstandings, which can create tension within the household.

For example, one family member may prioritize saving for future investments, while another may prefer spending on leisure activities.

Understanding these contrasting perspectives is essential to finding common ground.

Open communication is key to navigating these conflicts. It allows family members to express their financial preferences and priorities without judgment, fostering an environment of mutual respect and understanding.

Open communication is key to navigating these conflicts. It allows family members to express their financial preferences and priorities without judgment, fostering an environment of mutual respect and understanding.

Transparency about income, expenses, and individual financial goals can help each member feel involved in the decision-making process regarding joint expenditures.

Establishing family meetings to discuss finances can serve as a proactive measure, ensuring that everyone is on the same page and can share their views regarding the joint wallet.

Adopting a structured approach can also prevent misunderstandings from escalating into larger disputes.

Setting regular financial check-ins, whether monthly or quarterly, provides a designated time for family members to review their joint finances.

During these check-ins, it is beneficial to discuss upcoming expenses, evaluate budget adherence, and make necessary adjustments to financial plans.

Creating a written budget that accounts for everyone’s input can also facilitate clarity and limit conflicts, as it outlines agreed-upon spending limits and areas of financial focus.

Moreover, offering financial literacy resources to all family members can further bridge the knowledge gap.

Workshops, online courses, or even simple shared reading materials can elevate everyone’s understanding of financial management, enabling informed discussions.

Understanding each other’s financial viewpoints and maintaining open lines of communication serves as a foundation for resolving conflicts and promotes harmony in the family’s financial dealings.

Tips for a Successful Joint Financial Life.

Establishing a robust financial partnership through a joint family wallet requires careful planning and open communication.

To embark on this journey successfully, couples should prioritize setting shared financial goals.

Begin by discussing long-term aspirations, whether it’s buying a home, funding children’s education, or saving for retirement.

Clear and mutual objectives provide direction and motivation for both partners, ensuring that financial decisions align with their shared vision.

Creating a budget together is another essential step. A well-structured budget can assist couples in tracking their income, expenses, and savings.

This process not only enables them to monitor their spending habits but also fosters collaboration.

Utilize budgeting tools and applications that cater to joint finances, allowing both partners to contribute ideas and reach consensus on financial priorities.

Regularly reviewing and adjusting the budget encourages transparency and accountability in managing shared funds.

While working towards collective financial goals, it is equally important to maintain individual financial autonomy.

Each partner should have a say in personal spending and saving, which fosters independence and reduces potential resentment.

Establishing personal accounts alongside the joint family wallet can help both partners retain their financial identities while still supporting joint ventures.

Lastly, managing finances together hinges on the pillars of mutual respect, trust, and patience.

Open and honest discussions regarding money can help clarify expectations and reduce misunderstandings.

Open and honest discussions regarding money can help clarify expectations and reduce misunderstandings.

Conflicts may arise from time to time, but approaching these disagreements with empathy and understanding can transform challenges into opportunities for growth.

By embracing these principles, couples can cultivate a joint family wallet that not only supports their financial goals but also strengthens their partnership.

Ultimately, these strategies create a financially healthy relationship built on unity rather than conflict.

Have Good Day!

Regularly reviewing and adjusting the budget encourages transparency and accountability in managing shared funds.